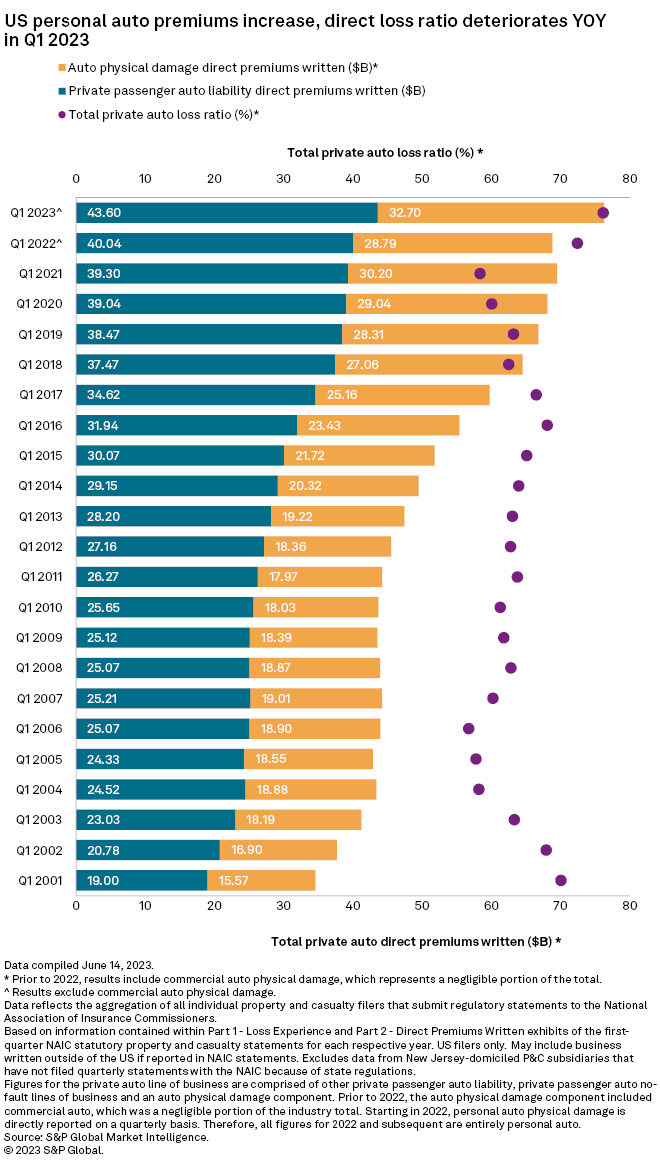

Continuing a multi-year trend, US private auto insurance premiums saw another major surge in Q1 2023, reaching $76.30 billion, an increase of $7.48 billion compared to the previous year, as per S&P Global Market Intelligence. The insurance sector recorded an increase in net earned premiums by 9.7% and a decline in dividends to policyholders by 2.2%.

Why the cacophony? It’s simple: those rising premiums aren’t translating into profit. Instead, they’re fueling an inferno of ballooning administrative and management costs without proper Insurance Back Office Management. Insurance agencies’ bottom lines are being devoured by paperwork and compliance. Though the insurance companies are working harder, juggling more policies, the scales tip further and further out of your favor.

According to the preliminary analysis by credit rating agency AM Best, the Property and Casualty (P&C) insurance sector in the United States experienced an underwriting deficit of $32.2 billion during the initial three quarters of 2023. This represents a deterioration of $7.6 billion compared to the 2022 timeframe. At the same time, there was a notable rise of 11.9% in losses incurred and expenses related to loss adjustment. Additionally, the sector witnessed a 7.3% hike in other expenses associated with underwriting.

Is there any good news? There is. Insightful insurance agencies are discovering an efficient strategy to circumvent these challenges: Delegate the heavy lifting of insurance back office operations to trustworthy partners through insurance agency support. By dovetailing their expansive abilities with the company’s long-term objectives, outsourcing offers a promising path to success. Here are 5 strategic aspects you must look for while choosing Insurance Back Office Management.

1. Insurance Agency Back Office Support with Expertise

Insurance Back Office Management isn’t mere data entry; it’s mastery over complex tasks like policy verification, claims processing, and certificate issuance. Don’t settle for amateurs! Seek a partner with proven expertise in handling intricate insurance back office operations. Look for a team steeped in industry knowledge, wielding their magic to seamlessly integrate with your specific needs, ensuring they can banish even the most stubborn paperwork demons.

2. Data Security: Your Impregnable Digital Safeguard

In the insurance industry, data is the lifeblood of your business. Protecting it requires a robust and comprehensive security strategy that safeguards sensitive information from even the most sophisticated cyberattacks.

When choosing an Insurance Back Office Management partner, prioritize one who upholds the highest data security standards, evidenced by the following:

- Rigorous Compliance: Seek a partner who meticulously adheres to all relevant data privacy and security regulations, exceeding minimum requirements whenever possible.

- State-of-the-Art Security Infrastructure: Their infrastructure should prioritize advanced data encryption technologies, employing industry-leading algorithms to ensure sensitive information remains unreadable in unauthorized hands.

- Proactive Risk Management: Regular security audits and penetration testing should be an integral part of their operations, proactively identifying and mitigating security risks before they can be exploited.

3. Insurance Back Office Management with Ever-Ready Customer Support

Exceptional customer support lies at the heart of successful Insurance Back Office Management. When choosing your ally, ensure they embody the following qualities:

- Responsive and Proactive: Timely answers to your questions are not a luxury but a necessity. Seek a partner with a culture of immediacy, where proactively anticipating your needs becomes second nature.

- Solution-Oriented: Challenges are inevitable, but your Insurance Back Office Management partner should relish the opportunity to overcome them. Look for those who approach problems with ingenuity and resourcefulness, crafting swift and effective solutions that keep your operations flowing smoothly.

- Dedicated Communication: Regular updates are not just informational; they’re a vital lifeline of trust. Choose a partner who prioritizes clear and consistent communication, keeping you informed at every step and ensuring seamless collaboration.

4. Talent Pool: A Must for Insurance Back Office Operations

Your success hinges on assembling an elite operational squadron, a team of professionals whose expertise and dedication propel your agency forward.

- Unmatched Qualifications: Seek a team with experienced insurance professionals honed in their craft through rigorous training and extensive industry experience. They should wield the blade of efficiency, expertly streamlining processes and maximizing output.

- Deep Insurance Knowledge: They should be more than just data processors; they must be guardians of knowledge with a comprehensive understanding of insurance regulations, procedures, and best practices. This shield of knowledge ensures accuracy, compliance, and optimal results.

- Commitment to Insurance Back Office Management Excellence: Their passion should extend beyond mere back-office expertise. They should be champions of Insurance Back Office Management, dedicated to delivering exceptional service and staying at the forefront of industry advancements.

5. Cost-Effectiveness: With Insurance Agency Support

While cost considerations are not scoffed at, don’t be lured by cheap imitations! By opting for a partner that aligns with these criteria, agencies can expect to realize cost savings of up to 40% without compromising on quality or service. In doing so, select a partner dedicated to driving your agency towards a future marked by substantial profitability and continuous expansion, bolstered by an efficiency boost of approximately 30%.

It is Time to Unburden Yourself with Efficient Insurance Back Office Management

Experience the convenience and efficiency of having all these five key points under one umbrella. Consider leveraging over 15 years of experience with Insurance Back Office Pro to streamline your operations and reduce operational costs. We offer comprehensive insurance back office management tailored to your needs.

Insurance Back Office Pro offers efficient insurance agency back office support that can revolutionize how your insurance agency operates. With our eight global delivery centers, we’re equipped to provide continuous, round-the-clock services. Partner with us and propel your insurance firm towards its mission: delivering superior customer service, fostering a more customer-centric approach, and driving overall business growth.

Insurance Back Office Pro assures:

- Efficient Business operations at an economical price, providing optimal value for your investment.

- A customer-centric approach that builds lasting relationships.

- Sustainable business growth with streamlined insurance agency support.

Untangle the chaos, unleash your potential, and watch your insurance agency soar. Let Insurance Back Office Pro be your guide.