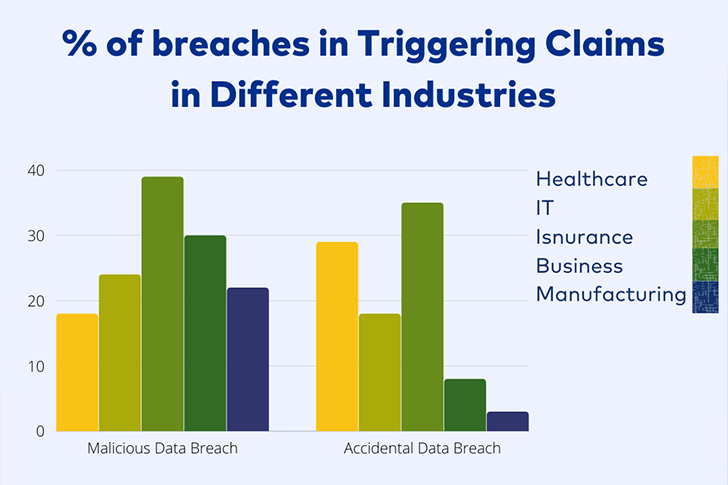

The insurance industry accounts for the highest number of data breaches compared to healthcare, IT, private business, and manufacturing. This includes both malicious and accidental data breaches. However, do you know that insurance companies often underestimate the significant costs associated with managing insurance customer data? It is time to recognize the substantial investment required to handle insurance customer data effectively. McKinsey’s research reveals that even a midsize institution with $5 billion in operating costs can spend over $250 million solely on various aspects of data management, from third-party data sourcing to governance and consumption.

Source: 64 Cyber Insurance Claims Statistics 2023-2024 – Astra Security Blog

Data-related expenses typically consume a significant portion of total IT budgets, ranging from 5 to 10 percent. These costs can escalate further for insurers, constituting up to 30 percent of their overall expenditures.

We have observed firsthand how insurance customer data breach incidents and the complexities of data collection, management, storage, privacy, compliance, and cleanup contribute substantially to operational costs. Cyber Insurance Claims Statistics 2023-2024 show the following incidents caused significant loss and claims triggers for the insurance industry:

- Malevolent data leak: 39%

- Unintentional data leaks: 35%

- Ransomware: 4%

- Social engineering: 7%

Exploring the Overlooked Facts About Insurance Customer Data

Let’s examine how the world of insurance customer data shapes various facets of the insurance sector. Knowing the nuances of insurance customer data is essential to your success as an insurance professional.

Risk Assessment and Underwriting: As an insurer, you use data to evaluate risks and establish reasonable rates for your products. By examining customer demographics, health records, driving records, and property details, you may determine appropriate coverage and price structures and accurately estimate the possibility of claims. This data-driven approach enhances your ability to make well-informed decisions regarding policy acceptance and terms.

Claims Management and Fraud Detection: Insurance customer data is essential for effectively managing claims and spotting fraudulent activity. It also helps with fraud detection. By closely examining past claims data, you can identify trends and abnormalities that speed up settlements and simplify claims processing. By using data analytics approaches to identify suspicious trends or discrepancies in claims data, you can potentially identify possible fraud.

Customer Relationship Management and Personalization: Insurance customer data can enhance customer interactions and offer customized services. Learning about clients’ preferences and habits allows you to tailor your products and services to meet their demands. Data-driven customer segmentation and tailored marketing techniques improve customer satisfaction, retention, and cross-selling opportunities.

According to Cybersecurity Ventures, alarmingly, a business, consumer, or device is targeted by a cyber attack every 11 seconds, a trend predicted to worsen.

Let’s now examine the essential characteristics of insurance client data that these apps rely on:

When working in the insurance industry, you are exposed to various data attributes essential for effective insurance operations. These features include policyholder information such as name, age, gender, contact details and insurance parameters such as coverage limits, deductibles, and premiums. Data may also include:

- Relevant financial activities.

- Information about insurance brokers or agents.

- Facts about insured vehicles or properties.

By leveraging the potential of insurance customer data and comprehending its fundamental characteristics, you can enhance your insurance operations and propel success in a data-driven world.

Establishing a robust and efficient data governance framework is imperative to harness this power of insurance customer data and drive success in a data-centric world. It becomes exceptionally crucial when dealing with sensitive information such as insurance customer data.

Designing Data Governance for Insurance Customer Data

Insurance companies often need help managing their vast amounts of insurance customer data scattered across multiple sources and systems. Time and resources may be lost due to severe inefficiencies in data identification, intake, purification, and engineering. To overcome these obstacles, insurance businesses can use

- a data governance strategy prioritizing federated data architecture,

- cloud-first practices, and

- disciplined domain-based governance.

Our research indicates that without effective data governance, data users can spend up to 40% of their time searching for data and up to 30% on data cleansing. Insurance companies can significantly improve productivity and performance by establishing data dictionaries, creating traceable data lineage, and implementing data quality controls.

However, finding a balance between data control and the requirement for flexibility is essential. Insurance businesses should focus on the most critical data items and processes when prioritizing data governance, considering needs, value, and risk. For instance, they may need to employ more robust controls around sensitive customer data, such as insurance claims and policy information, than around less sensitive data, like marketing materials.

Optimizing Insurance Customer Data Consumption for Efficiency

To streamline data consumption, insurance companies can map reports by topic, redesign data-gathering processes, automate pipelines, and explore new ways to model and visualize data. This holistic approach helps synthesize production across the organization, ensuring that reports and metrics are high quality and take little effort to curate.

Additionally, insurance companies can benefit from making their business intelligence capabilities available to employees on a self-serve basis. This allows remaining business intelligence resources to focus on more complex reporting needs and issue remediation. By implementing these strategies, insurance companies can improve their data governance, reduce costs, and enhance their overall performance.

The Growing Problem of Insurance Customer Data Breaches

In the modern digital world, a data breach involving insurance clients is more likely than ever. Because insurance firms contain a lot of sensitive data, they have become a target for cybercriminals. Insurance firms are a desirable target because they can access personal information, payment information, health records, and property data.

According to IBM’s Cost of a Data Breach Report, the global average data breach cost in 2023 was USD 4.45 million, a 15% increase over 3 years. Costs associated with violations in the insurance sector can increase even more; on average, healthcare and financial services cost $6.45 million. These hacks are not isolated incidents; they have far-reaching economic ramifications beyond the initial attack.

One example is the 2014 Anthem data breach, which impacted 78.8 million patients and led to a nearly $40 million settlement with a coalition of 44 states and Washington, DC. More recently, in 2020, the Access CT hack leaked 1,100 papers, demonstrating the profound impact that even seemingly small events may have.

Insurance Data Breach and the Effect on Your Company

There is more to a breach of insurance customer data than just financial loss. It might damage your brand and erode customer confidence. When they hear of a breach, customers worry about the security of their data, even if they were not directly affected. This mistrust could drive customers to your competitors’ insurance offerings, lowering sales.

Regulatory requirements also require you to notify customers about data breaches, which adds to the administrative load and could have legal repercussions. Severe penalties for noncompliance could make things more expensive for you.

The Challenge of Protecting Insurance Customer Data

Safeguarding client data for insurance companies is a challenging task. You have several challenges to face, including:

- Complex Data Systems: Security vulnerabilities are increased when insurance companies use many platforms and systems.

- High Volume of Data: Because Insurance companies collect and keep so much data that it is difficult to secure it properly.

- Changing Cyberthreats: Cybercriminals constantly devise new strategies to exploit vulnerabilities, so you must continuously be on the lookout and adaptable.

- Regulatory Compliance: Complying with regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) makes the process of data handling, storage, and sharing secure, transparent, and trustworthy.

Recent data from Insurance Times shows that 63% of UK insurance executives invest in AI and machine learning, compared to 50% in the US.

Realistic Approaches to Prevent Insurance Customer Data Breach

To protect insurance client data and prevent breaches in insurance customer data, think about implementing the following strategies:

- Perform recurring risk assessments and audits: Investigate and audit your data systems to identify potential security flaws. Take aggressive steps to resolve these vulnerabilities to prevent breaches.

- Make an Investment in Advanced Security Technologies: To protect your data, use firewalls, encryption, and intrusion detection systems. Consider cloud-based applications with integrated security.

- Educate Your Staff: Ensure employees are trained on the best protection procedures for sensitive data. Human mistakes frequently lead to data breaches, so teach your employees secure data handling techniques and how to recognize phishing scams.

- Establish Robust Access Controls: Limit access to sensitive data based on job roles. To improve security, use multi-factor authentication.

- Create a Plan for Responding to Data Breaches: Create a detailed plan for responding to data breaches. This strategy should involve putting an end to the hack, notifying the affected clients, and supporting law enforcement.

Achieve Advanced Security & Streamlined Processes with Insurance Back Office Pro

At Insurance Back Office Pro, we know your challenges in protecting client information. Our back-office support services are designed to help businesses maintain stringent security standards while improving operational performance. Here’s how we can assist you:

- Secure Data Handling: We ensure all data is handled securely, abiding by compliance requirements and best practices, to prevent breaches involving the personal information of insurance customers.

- Advanced Technology Solutions: We provide our clients with state-of-the-art encryption and secure data storage to increase data security.

- Effective Process Management: By streamlining your back-office processes, we can help you better control your data and reduce the likelihood of breaches caused by human error.

- Compliance Support: We guide you through legal requirements and ensure that your data security protocols comply with applicable regulations.

Conclusion

Protecting your clients’ data can help you avoid financial loss, maintain their trust, and ensure the long-term success of your business. By addressing the issues brought on by breaches involving insurance customer data and implementing robust security measures, you can safeguard your business and provide your customers with the peace of mind they deserve.

At every step, Insurance Back Office Pro is here to support you with the robust backend services you need. With our comprehensive back-office services, you can improve data security, comply with regulations, and increase overall efficiency. Don’t let the prospect of a data leak concerning insurance clients deter you. Collaborate with us to protect confidential data about your customers and business.

Visit Insurance Back Office Pro for additional details on how we can assist. Let’s safeguard your future and develop a more robust and resilient insurance company together.