In 2022, state insurance departments conducted 4,379 financial and 1,260 market conduct examinations, highlighting the critical need for compliance with insurance regulations. More than 280,000 consumer complaints were managed by the Consumer Services Division, emphasizing the financial and reputational risks of non-compliance and over $200 million in fines were issued for regulatory breaches.

This blog post focuses on crucial strategies for CROs and CCOs to master insurance regulations and manage associated risks. We outline proactive measures to stay ahead of regulatory changes, enhance compliance programs with advanced risk management tools, and promote a culture of transparency and continuous education within your team. These steps ensure your company not only meets but exceeds regulatory standards.

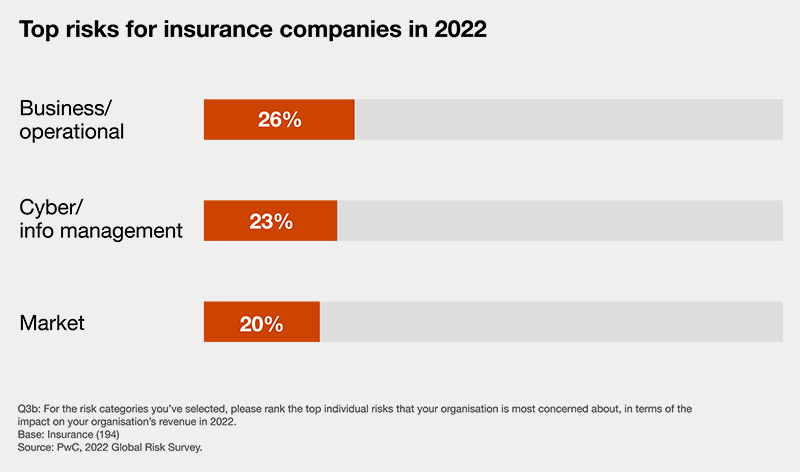

Top Risk Factors for Insurance Companies

Source: Global Risk Survey Findings: Insurance risk: PwC

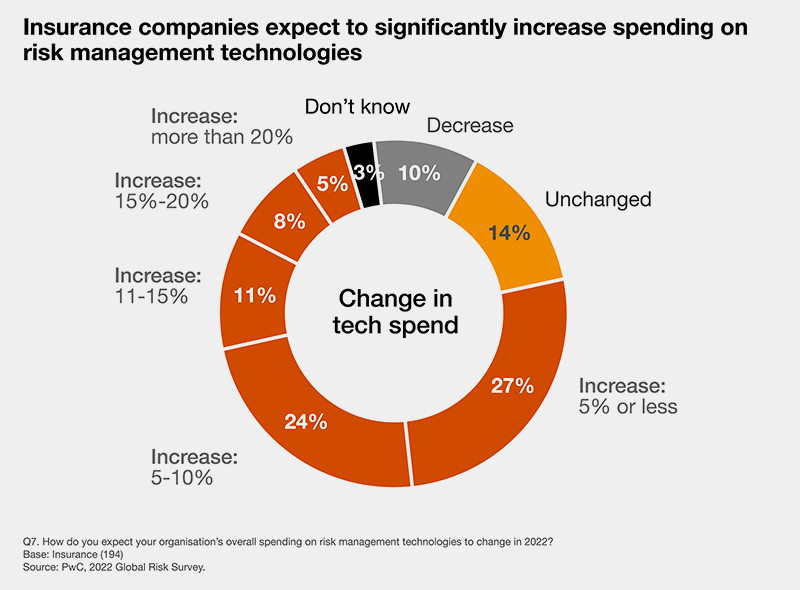

Source: Global Risk Survey Findings: Insurance risk: PwC

Introduction:

First, did you know that the U.S. insurance industry is one of the most heavily regulated sectors? According to the National Association of Insurance Commissioners (NAIC), over 5,950 insurance companies in the U.S. (577 of which are located in New York state) generated total direct written premiums in 2022, amounted to $2.3 trillion, marking a 6.4% increase from the previous year. That’s a colossal amount of money and much ground regarding regulatory compliance.

Let’s break it down.

Insurance Regulations: The Rulebook

Think of insurance regulations as the rulebook that every player in the insurance game must follow. These rules, set by federal and state bodies, serve a vital purpose. They protect customers, ensure fair play, and stabilize the market. From dictating how claims are processed to setting standards on how much capital an insurer must hold, these regulations shape every aspect of the insurance industry.

Risk Implications: What’s at Stake?

Now, let’s talk about the “risk implications.” This term sounds like jargon, but it’s about understanding what could go wrong if you don’t play by the rulebook. If an insurance company decides to skip a few rules, it might face hefty fines, damage its reputation, or even risk going out of business. But it’s not just about avoiding penalties; it’s also about spotting opportunities within these regulations to stand out and excel in the market.

What Does This Mean for You?

If you’re a decision-maker in an insurance company, such as the Chief Risk Officer or Chief Compliance Officer, you need to know the play (regulations) inside out and what’s at stake (risk implications) every time you make a call. This isn’t just about keeping your team out of trouble; it’s about leading them to victory by navigating these rules skillfully.

Tightened Insurance Regulations

Implementation of stringent insurance regulations is on the rise. The NAIC’s 2022 annual report indicated a significant uptick in market conduct examinations and financial audits. Regulatory fines in the insurance sector have surged 15% over the past five years. This means more eyes are on you, ensuring every ‘i’ is dotted and every ‘t’ is crossed.

Financial Risks

Financial risks are a major concern in the insurance industry. Non-compliance can lead to significant fines and penalties. In 2022, regulatory violations resulted in fines and penalties amounting to over $1.3 billion. This isn’t merely a slap on the wrist; it’s a substantial financial burden that can severely impact your bottom line and disrupt business operations.

Operational Risks

Operational risks are another piece of the puzzle. Implementing new regulations often requires overhauling systems and processes. A Deloitte survey found that 60% of insurance companies had to significantly alter their operational procedures to comply with new regulations introduced in the last three years. This means more time, resources, and headaches for your team.

Reputational Risks

Let’s not forget reputational risks. In today’s digital age, word spreads fast. A single regulatory breach can tarnish your brand’s reputation. According to a survey by PwC, 70% of consumers said they would lose trust in an insurance company following a high-profile regulatory breach. Trust is hard to build and easy to lose; maintaining compliance is crucial to preserving your reputation.

Source: Compliance In The Insurance Industry – FasterCapital

Key Strategies for Navigating Insurance Regulations

So, how do you navigate these choppy waters? Here are some key strategies:

- Strengthen Compliance Programs: Regular audits and updates are a must. Keeping your compliance programs robust and current is your first line of defense.

- Invest in Risk Management Tools: Modern tools can automate compliance tasks, making staying ahead of the curve easier.

- Enhance Transparency and Communication: Keep your team and stakeholders in the loop. Transparency fosters trust and ensures everyone is on the same page.

- Regular Training and Education: Your staff needs to be informed. Regular training sessions can keep everyone up to date with the latest regulations and best practices.

Expansion of Insurance Regulations

Understanding insurance regulations isn’t just about keeping your nose clean—it’s about steering your ship safely through turbulent waters. As a CRO or CCO, you must understand why it’s crucial for you. That’s because you have much more on your plate than your predecessor.

NAIC 2023 Prioratized Insurance Regulations (in alphabetical order)

Climate Risk/Natural Catastrophes and Resiliency:

- Address climate risks and protection gaps through consumer education and support from state insurance departments.

Data/Artificial Intelligence, Cybersecurity, and Innovation:

- Update model laws and create frameworks for responsible AI use and cybersecurity in insurance.

Insurer Financial Oversight and Transparency:

- Maintain a solvent and accountable insurance marketplace.

Long-Term Care Insurance (LTCI):

- Transition to a long-term strategy with the Multistate Actuarial Review Framework.

Marketing of Insurance Products:

- Combat deceptive marketing with a new tool for checking insurance producers’ license status.

Race and Insurance/Protection Gaps and Financial Inclusion:

- Focus on closing protection gaps and increasing financial inclusion, particularly for underrepresented communities.

In 2024, another member was added to this priority family.

Use of AI by Insurers and Cyber Risk:

- Address opportunities and challenges from AI in terms of consumer privacy, cyber risk, and regulatory complexity.

Source: Global Risk Survey Findings: Insurance risk: PwC

Understanding Insurance Risk Mitigation

The Role of the Insurance Regulatory Authority

The world of insurance regulation is populated by various regulatory bodies, each with its own rules and mandates. In the United States, the primary regulators include state insurance departments, the National Association of Insurance Commissioners (NAIC), and federal entities like the Securities and Exchange Commission (SEC) for publicly traded insurance companies. Each body has its own set of insurance regulations to focus on: consumer protection, financial solvency, or market conduct.

Description of the Role of CROs and CCOs in Managing Insurance Regulations

As a CRO or CCO, your role is pivotal in managing regulatory scrutiny as designed by the insurance regulatory authority. You’re the sentinel, ensuring that all operations align with the current regulations. This means staying updated on new regulations, conducting regular compliance audits, and being the bridge between your company and regulatory bodies. Your job is to mitigate holistic insurance risk before it becomes an issue and maintain your company’s integrity and reputation.

The Current Regulatory Landscape

Overview of the Current State of Regulation in the Insurance Industry

The insurance industry is no stranger to regulatory scrutiny, and in recent years, this scrutiny has only intensified. Regulatory bodies continuously update their frameworks to address emerging risks, such as cyber threats, data privacy issues, and complex financial instruments. This evolving landscape means more than what worked yesterday might be needed today.

Explanation of Recent Changes and Trends in Regulatory Scrutiny

Recent trends in regulatory scrutiny highlight an increased focus on transparency, accountability, and consumer protection. For example, the NAIC has ramped up its efforts to enforce stricter reporting requirements and more rigorous financial examinations. Additionally, there is a growing emphasis on cybersecurity measures, given the rise in cyberattacks targeting sensitive insurance data.

Risk Implications Failing to Meet the Insurance Regulations

Financial Risks

Increased regulatory scrutiny often translates to higher compliance costs. This can strain your financial resources, especially if your company isn’t adequately prepared. Fines and penalties for non-compliance can also significantly affect your bottom line.

Operational Risks

Operational risks include the potential for disruptions to your business processes due to compliance requirements. Implementing new regulations may necessitate changes to your systems and workflows, which can be both time-consuming and costly.

Reputational Risks

In today’s digital age, news travels fast. Regulatory breaches can quickly become public, leading to reputational damage that can be hard to repair. Maintaining compliance is crucial to preserving your company’s good name and trustworthiness in the eyes of clients and stakeholders.

Strategies for Navigating Insurance Regulations for Agencies

Strengthening Compliance Programs

A robust compliance program is your first line of defense against regulatory scrutiny. Regularly review and update your policies to ensure they align with the latest regulations. This proactive approach can help you catch potential issues before they escalate.

Investing in Risk Management Tools

Modern risk management tools can help you monitor and manage compliance risks more effectively. These tools can automate many compliance tasks, freeing up your time to focus on more strategic activities.

Enhancing Transparency and Communication

Transparency and open communication are key to navigating regulatory scrutiny. Keep all stakeholders informed about compliance efforts and changes to regulatory requirements. This fosters a culture of compliance and ensures everyone is on the same page.

Regular Training and Education for Staff

Your staff is your greatest asset in maintaining compliance. Regular training sessions can help them stay informed about regulatory changes and understand their role in ensuring compliance. This ongoing education is crucial in fostering a compliance-conscious culture.

Challenges and Recommendations

Overview of Potential Challenges CROs and CCOs Might Face When Dealing with Insurance Regulations

Navigating regulatory scrutiny in insurance has its challenges. From keeping up with the constant changes in regulations to managing the associated costs, CROs and CCOs have their work cut out. Additionally, balancing the need for compliance with operational efficiency can be a delicate act.

Recommending Outsourcing to Overcome These Challenges

One effective way to overcome these challenges is to outsource compliance and risk management functions to a trusted partner. By leveraging our expertise and resources, you can focus on your core operations while ensuring compliance. Our specialized services can help you stay ahead of regulatory changes and manage compliance for effective insurance risk mitigation.

Outsourcing to Ensure Efficiency in Insurance Regulations

Facing all the challenges discussed above will take significant time, including infrastructure setup, hiring skilled resources, and other financial investments. That’s where outsourcing can make a big difference. Partnering with a back-office support provider, Insurance Backoffice Pro, can help you manage insurance regulatory scrutiny more effectively. By leveraging our expertise, you can focus on your core operations while ensuring compliance and mitigating risks.

Conclusion

At Insurance Backoffice Pro, we understand that keeping up with every change and nuance in insurance regulations can be like trying to hit a moving target while blindfolded. With 15 years of extensive U.S. industry experience, we offer to lighten your load by handling the complex, time-consuming tasks that these regulations entail, allowing you to focus on strategy and growth.

Think of us as your co-pilot in navigating insurance regulations, often compared to the turbulent skies of the insurance industry. Whether staying ahead of the curve on new insurance regulations or managing the risks, we’re here to help you fly smoothly and safely to reach your business destinations.

For more information on how we can help you navigate insurance regulations, visit Insurance Backoffice Pro and take the first step towards a more secure and compliant future.