The insurance industry faces one of the highest customer acquisition costs compared to all other sectors, with an average cost reaching as high as $900 per new customer. Without a strong focus on insurance renewals, agencies risk losing valuable customers, increasing their dependency on expensive new client acquisitions. Insurance renewals help maintain a steady revenue stream and ensure customer loyalty and satisfaction. This discussion, backed by compelling statistics, focuses on why insurance renewals are essential.

Introduction to Insurance Renewals

What is the secret sauce for client retention in the insurance industry? It’s right at your fingertips in the form of insurance renewals! They provide fundamental data that can be used to measure customer satisfaction and brand loyalty. Proactive evaluations of insurance renewals are one of the best ways for any insurance firm to solve difficulties with client retention.

Pour your time and energy into boosting your insurance business. Don’t let it go to waste. A well-drawn plan can be your magic wand to generate superior leads and secure existing clients. Remember, proactive marketing always trumps reactive marketing, and having a lucid client retention plan is not just important, it’s indispensable.

Now, let’s examine some startling figures that demonstrate the significance of customer retention tactics in the insurance sector:

- 65% of clients who leave an agency only had a conversation with a representative without any follow-up call before their exit. This shows the critical importance of maintaining regular communication with your clients.

- 80% of customers who maintained regular contact with an agent stayed with their insurance provider during the year. Regular contact can significantly boost insurance renewals.

- Only 13% of your book of business is truly loyal. This means most of your clients are at risk of switching providers if they are appropriately engaged.

Source: Insurance Retention Performance

- 52% of insurance customers describe themselves as relationship buyers. Building strong relationships with your clients can be a powerful retention tool.

- One in three people will look for a new auto insurance policy each year. Maintaining a relationship with your clients can help you keep them from searching elsewhere because the competition is strong.

- 50% of these potential customers will review a quote before purchasing. This highlights the importance of being their first choice and maintaining top-of-mind awareness.

Insurance companies witnessed a remarkable 25% increase in operational efficiency by outsourcing core administrative tasks!

Calculating Insurance Customer Acquisition Costs (CAC)

The Customer Acquisition Cost (CAC) is a crucial metric for every insurance company like yours. It talks about every dollar spent in attracting a prospective lead and turning the lead into paying customers through advertising, marketing, and sales. With a clear idea of CAC, you can evaluate the effectiveness and efficiency of your client acquisition initiatives.

How Do You Calculate Customer Acquisition Costs?

A CAC calculation entails adding up all expenses for bringing in new customers. You should include as follows:

- Advertising Costs: Costs associated with advertising and marketing include pay-per-click advertisements, social media ads, digital ads, cold calling, and more.

- Sales staff Expenses: Remember that a sizeable chunk of your customer acquisition cost accounts for the commissions, salary, and bonuses your sales staff receives.

- Technology Expenditures: You should also factor in the price of any tools or software you use for marketing automation, customer relationship management (CRM), or sales data analytics.

- Lead generation and Marketing costs: These comprise partnership fees, events, and marketing that are spent to generate both online and offline leads.

- Other Associated Expenses: You should also factor in any other costs connected to acquiring new customers, directly or indirectly.

The Formula for CAC

To find your CAC for a specific period, use this simple formula:

Customer Acquisition Cost (CAC) = Total Sales and Marketing Expenses / Number of Customers Acquired

For example if you spent $900,000 on sales and marketing in a month and acquired 1000 new customers, your CAC would be:

CAC = $900,000 / $1,000 = $900

This means it costs you $900 to acquire each new customer during that period, which is also industry standard.

By understanding and monitoring your CAC, you can make more informed decisions about your marketing and sales strategies, ensuring you get the best return on your investment.

Need to Address Rising Insurance Customer Acquisition Costs

The Future of Life Insurance | McKinsey reported that in the last few years, the cost of acquiring new customers in the insurance sector has risen by more than 50%. Insurance acquisition costs are rising due to the customer demand for more individualized services, regulation changes, and the expense of digital marketing. This trend isn’t slowing down as every insurer tries to make their plans more specific to every demographic need.

The statistics Speak for Themselves:

- The average cost of acquiring a new insurance customer ranges from $800 to $1300, depending on the type of insurance and targeted demography.

- Insurance Renewals are five to seven times cheaper than acquiring new customers.

- An increase in customer retention by 5% can boost profits by 25% to 95% (Source: contentsquare.com)

These data highlight the significant value of renewals in insurance. Focusing solely on new customer acquisition is not a sustainable business model for insurance agencies. The solution lies in prioritizing insurance renewals.

How Renewals in Insurance Matter?

Understandably, a successful insurance agency relies heavily on customers’ insurance renewals. In the insurance business, keeping a current client can be up to six times less expensive than finding a new one, with an average acquisition cost of approximately $900. For instance, if keeping a client costs $150, getting a new one will cost six times as much. The considerable financial benefit of putting client retention ahead of new customer acquisition is highlighted by this striking contrast. This is why they are so important:

Steady Revenue Stream

Renewing insurance offers a reliable and consistent source of income. Agencies guarantee a steady income stream without continually spending money on finding new clients when clients renew their policies. This financial stability paves the way for agencies to plan strategically and invest in other growth areas, fostering overall business success.

Customer Satisfaction

Insurance renewals encourage patronage. Retention of policyholders year after year is a sign of client satisfaction with the insurer. As a loyal customer, you can count on them to recommend others, which is another inexpensive way to get new business.

Reduced Marketing Costs

As previously indicated, renewing an insurance policy to keep a client is significantly less expensive than finding a new one. Agencies can drastically cut their marketing and advertising expenditures by concentrating on insurance renewals and then use the saved money to enhance services or increase options.

Enhanced Customer Experience

Frequent insurance renewals enable companies to interact with customers, comprehend their changing requirements, and provide customized services. This proactive approach makes customers feel appreciated and understood, improving the customer experience.

Gaining a Competitive Edge

Insurers must set themselves apart to attract and keep clients in a competitive industry. Widespread, effective communication channels can give insurers a substantial competitive edge. Efficient renewal procedures enhance policyholder perceptions and help insurers differentiate themselves from competitors.

Insurance Agency Management Services is projected to expand to USD 4.83 billion, showcasing a Compound Annual Growth Rate (CAGR) of 8.5% from 2022 to 2028.

Enhancing Operational Efficiency

Streamlining renewal processes with digital solutions that automate time-consuming and repetitive tasks often increases operational efficiency. Automation of insurance operations reduces errors, expedites response times, and frees up resources for more strategic tasks. Increased productivity lends the company greater agility and readiness to tackle industry difficulties, many of which revolve around future projections.

Ensuring Regulatory Compliance

The insurance sector needs to react to changes in national and international regulations as soon as possible. Insurance renewals need to adjust to changing rules and specifications quickly. Regulatory-compliant renewal procedures satisfy legal obligations and build client confidence since customers demand morality and accountability from their insurance.

Utilizing Data for Personalization

Providing personalized experiences at policy renewal time increases customer satisfaction and strengthens the insurer-customer relationship. Digital tools enable insurers to leverage data related to customer behavior and preferences. This data can be used to personalize communications, offers, and services, making the renewal process more relevant and engaging for customers.

The Retention Revolution: Why Are Renewals in Insurance Becoming More Critical Than Ever?

There needs to be more than the conventional approaches to client relationship management that were effective a few years ago. Effective insurance renewals support a company’s long-term viability, mainly because keeping a current customer base is usually less expensive than finding new ones. Find out statistics on how putting service first and intelligently consolidating policies can propel your agency’s expansion, from preventing comparison shopping to exceeding industry standards:

- Consumers who have already purchased coverage are 350% more likely to do so the following year. Maintaining the satisfaction of your current clientele might lessen the possibility that they will shop around.

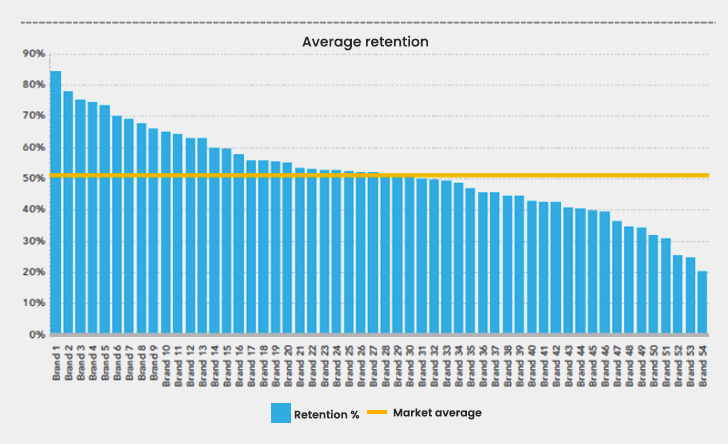

- The average retention rate in the insurance sector is 84%. The fact that top agencies beat this average by ten percent indicates the importance of effective retention tactics.

- While 28% of customers start shopping after receiving subpar service, 13% of consumers start shopping due to a fee rise. Offering competitive rates is less important than providing quality service.

- Retention for bundled policies is 91%, while only 67% for monoline policies. Encouraging clients to bundle their policies can significantly improve retention rates.

- At 85% retention, the average agency loses as many customers as it gains. This highlights the critical need for effective retention strategies to ensure net growth.

Investing in Digital Innovation for Robust Insurance Renewals

Even though the insurance sector has substantial expenses associated with customer acquisition, it makes financial sense to engage in insurance renewals. The average retention rate in OECD nations is approximately 85%. Retaining current clients is far less expensive than finding new ones. However, depending on present retention tactics, it might not cut it in the long run.

Dropping retention rates are already noticeable, according to an Accenture survey. Product innovation and the move to third-party digital platforms will impact about $280 billion, or 5% of insurance premiums worldwide. Insurers must move swiftly to preserve current revenues and keep retention rates from declining. Insurers can lessen the chance of experiencing a decline in client retention rates and significant financial losses by investing in consumer-focused digital innovation.

How Does Insurance Backoffice Pro Help?

For over 15 years, Insurance Backoffice Pro has offered backend support to ensure that the insurance renewal procedure runs seamlessly. Here’s how we can support you:

- With our latest data analytics tools, we provide backend assistance to forecast renewal dates and expected dollar value.

- To execute this, we establish and oversee effective communication channels that inform and involve your clientele.

- Our backend services guarantee that your customers never miss insurance renewals by sending them automated reminders.

- We employ user-friendly online interfaces to streamline your insurance renewal operations.

- Our products are made to simplify the renewal process for your customers and boost productivity for your staff.

Conclusion

Maintaining and expanding your insurance business amid increased acquisition costs requires a laser-like focus on insurance renewals. By prioritizing insurance renewals, you may guarantee a consistent flow of income, increase client loyalty, lower marketing costs, and enhance the general customer experience. You can use Insurance Back Office Pro’s assistance to optimize your renewal procedure, take advantage of data analytics, and provide individualized service that entices customers to return year after year. Renewing your insurance now will help your business grow.

Ready to improve your insurance renewals? Contact Insurance Back Office Pro to learn more about our insurance renewal operations and how we can help your agency succeed.