Managing Certificates of Insurance (COIs) is an important yet challenging task for insurance agencies. The sheer volume of COIs agencies handle is staggering; millions are processed annually, making efficient management paramount. However, the traditional in-house approach to managing these vital documents is frequently plagued by high costs, manual processes, and significant inefficiencies.

You need to hire dedicated staff, conduct timely training to meet compliances, invest in tools for insurance tracking and data management, and find strategies to minimize errors. You may find yourself gripped in a lot of paperwork trying to cut down operational costs as much as possible. Though this traditional approach offers you the control you want to seek in the process, it doesn’t favor scalability and efficient operations.

This blog post explores the challenges of in-house COI management and compares it with two strategic alternatives: leveraging advanced COI tracking software and outsourcing COI functions. We’ll delve into cost and efficiency metrics to help you determine the best approach for your agency. We’ll also highlight the convenience and comprehensive benefits of outsourcing.

The Financial and Operational Costs of In-House COI Management

In-house COI management is not only complex but also surprisingly expensive. Managing an in-house COI team incurs direct and indirect expenses. Let’s analyze the operational costs that may be incurred.

- Direct costs – Building your in-house COI management team will require investment in technology and human resources. Here’s a quick breakdown of your expenses:

| Expense | Average Annual Cost | Details |

| Staffing (1 FTE) | $50,000–$70,000 | Salaries for personnel to manage COI collection and compliance. |

| Training | $5,000–$10,000 per employee | Regular training on compliance updates and tools. |

| Technology Investment | $10,000–$20,000 | Basic software, storage solutions, and system maintenance. |

| Errors and Compliance | $15,000–$50,000 | Penalties, legal fees, and lost business due to non-compliance. |

- Indirect costs –

- Overhead expenses – To maintain your in-house compliance team, you need additional infrastructure, which will cost you rent, utilities, and management and administration costs.

- Downtime costs – To manage everything in-house, your team will also handle system downtime challenges. You know that unplanned downtime can impact the productivity of your entire team, and so will the effect on revenue.

Beyond these expenses, the following operational challenges significantly impact the bottom line.

- Error rates—COI management involves extensive documentation, renewals, calculations, reminders, and client handling. Manually managing these using legacy systems will lead to high error rates, risking compliance issues and potential legal liabilities. According to industry estimates, the error rates while handling manually are 5-10%.

Consider a mid-sized insurance agency that processes about 5,000 Certificates of Insurance (COIs) annually. In managing this volume manually, they might encounter between 250 and 500 errors, with each correction potentially costing $200 – $500!

- Scalability – The need for dedicated personnel, timed workforce training, and admin staff is directly proportional to the increased volume of COIs. This becomes challenging without automation, making in-house COI management less efficient for insurance agencies.

Comparing In-House COI & COI Tracking Software Solutions

![]()

Insurance agencies choose COI-tracking software solutions to minimize human errors and streamline the cumbersome task of COI management. Unlike in-house management, insurance tracking software uses automation and intelligent workflows to manage COI handling, validation, insurance tracking, sending reminders, and generating renewal certificates.

Optimize Processes With COI Management Software

Insurance tracking software automates processes, making managing them much easier. It handles important tasks like COI requests, tracking, and verification, helping to minimize errors and ensure better compliance. Plus, it eliminates the need for manual data entry by seamlessly integrating with CRMs and ERPs. With features like automated COI collection and renewal notifications, compliance monitoring, and centralized data, this software allows agencies to effortlessly ensure vendor compliance.

Avoid Cost Penalties And Risks Associated With Lapsed COIs

Leveraging AI-powered tools, COI tracking software cross-checks COIs against industry standards and regulatory requirements to enhance business compliance. Systematic monitoring of COIs ensures timely renewals to avoid cost penalties and safeguard against lapses.

Now, let us compare the costs of in-house COI management and COI tracking software to help you decide which is best for your agency.

| In–house COI Management | COI Tracking Software | |

| Staff salaries | $50,000–$70,000 annually per employee | No |

| Training | $5,000–$10,000 per employee annually | Minimal training costs (often included with software) |

| Technology / Tools | $10,000–$20,000 annually | Subscription $5000 – $25000 annually |

| Compliance penalties | $15,000–$50,000 annually | Reduced compliance penalties due to automation |

Initially, when you start with COI management, you may feel subscription prices are higher. But, in the long run, you will realize that opting for COI tracking software or outsourcing COI management operations can save you time and budget.

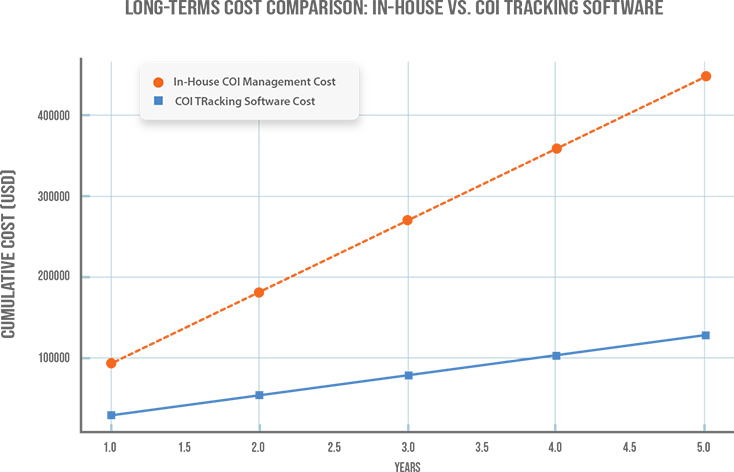

The graph compares the long-term costs of in-house COI management with COI tracking software. It highlights that the long-term savings from reduced operational efficiencies and compliance errors far outweigh the expenses when COI tracking software is deployed. Check and compare among the best certificate of insurance tracking software to get one for your agency.

Outsourcing COI Management: Enhanced Efficiency and Reduced Costs

Even when you opt for COI management software, you will need an in-house team to handle COI compliances, which will cost you time. By outsourcing the COI management functions of your agency, you can improve the operational efficiency of your team.

Here’s how outsourcing COI management will benefit you in the long run –

- Lowered cost: By counting on professional COI service providers, you can save on the expenses you otherwise make for hiring, training, and maintaining an in-house COI management team, such as payroll, taxes, perks, and workers’ compensation insurance. Also, it reduces your administrative burden.

Insurance Backoffice Pro (IBOP), the leading end-to-end certificate of insurance (COI) service provider, used intelligent workflows to increase efficiency and reduce operational costs by 50% for a US-based insurance firm.

- Improved compliance: They have a team of experts well versed in the evolving regulations to ensure compliance with COI requirements. With the necessary infrastructure of insurance management software, they can streamline the workflow required for your agency. It will significantly improve the operational efficiency of your business processes.

- Data security: Protecting customer data is one of the critical tasks for insurance agencies. McKinsey’s research says that even a mid-size agency with $5 billion in operating costs dedicates a budget of $250 to aspects of data management. Outsourcing insurance services can save you these expenses and give you access to advanced data security solutions to safeguard your customer data.

- Risk mitigation: Minimize errors in the renewal requests and compliance reports and achieve faster insurance services with professional COI providers. They have automated COI tracking software, well-versed resources, and needed infrastructure to minimize non-compliance risks.

- Greater focus on core activities: With reduced administrative burden, you can use your time and resources to focus on your business’s core activities. This allows you to bring more quality leads and scale your business.

- Over the last 15 years, Insurance Backoffice Pro (IBOP) has helped improve efficiency and simplify COI management for many insurance agencies and brokers. For example, it helped a US-based Fortune 500 insurance company improve its claims settlement by implementing improved workflows and analytics tools. This reduced claim processing times by 20% and enabled the company to process more claims.

Decision Framework for Insurance Agencies

COI management is one of the crucial processes for your insurance agency. Though opting for the best certificate of insurance tracking software seems like the right option for any insurance agency, does your business truly need that?

Consider the scale of operations your company is handling or planning to handle. Here, we’ve outlined which COI management option is best suited to your agency’s size.

- In-house COI management: When running a large agency with diverse insurance schemes, getting a dedicated in-house COI management team can be a favorable option for you. It will give you more control over operations and let you add profits to your pockets in the long run.

- COI management software: If your agency follows a standardized system and doesn’t need to customize processes and certifications, COI tracking software can help.

- Outsource COI management services: If you have an agency with specialized expertise and a restricted budget to get started, outsourcing COI services can be a good option.

Let’s dig deeper to find out which option is right for you. In the table below, you will see a detailed comparative analysis of COI management strategies based on different factors like cost, resources, security, scalability, and control over operations.

| Factors | In–house COI Management | COI Tracking Software | Outsourcing COI Services |

| Need for expertise | Expert and dedicated staff are needed | Little internal expertise to manage software | Access to experienced professionals from the agency |

| Cost | Higher initial cost + Recurring expenses to manage team | One-time software purchase cost + maintenance fees | Lower initial cost but potential recurring service fees |

| Data security | Greater control over data, but needs robust internal security protocols | Depends on the vendor’s security measures and compliance with industry standards | Vet potential providers to ensure data privacy and compliance |

| Control over operations | Highest level of control over processes and decision-making | Control of the data within the software but less control of overall operations | Minimal direct control. Need to rely on vendor’s expertise & processes for operations. |

| System integration | Manage manually or need custom development for integration with existing systems | Need to check for compatibility among systems. If compatible, system integration will be seamless | Connect with the vendor to check the compatibility of your existing systems with their current tech stack. |

| Scalability | Challenging to scale rapidly with changing business needs | Scalable depending on the functionality of the software chosen | Easily scale up or downsize per the requirements of your clients |

Simplify Insurance Tracking with IBOP

COI tracking software saves you from the efforts of hiring and managing an in-house COI management team. The process automation and AI integration with the software solution keep you from tedious, monotonous tasks and give you a pocket-friendly alternative to power your insurance agency.

Moreover, if you plan to scale faster, consider outsourcing COI management services with Insurance Backoffice Pro (IBOP). Getting an external team to handle insurance tracking for your business gives you a fair share of relief while managing other operations. Outsourcing enhances your efficiency and allows you to stay competitive by focusing on your expertise.

Contact us today for a consultation to learn how we can help optimize your COI management process.