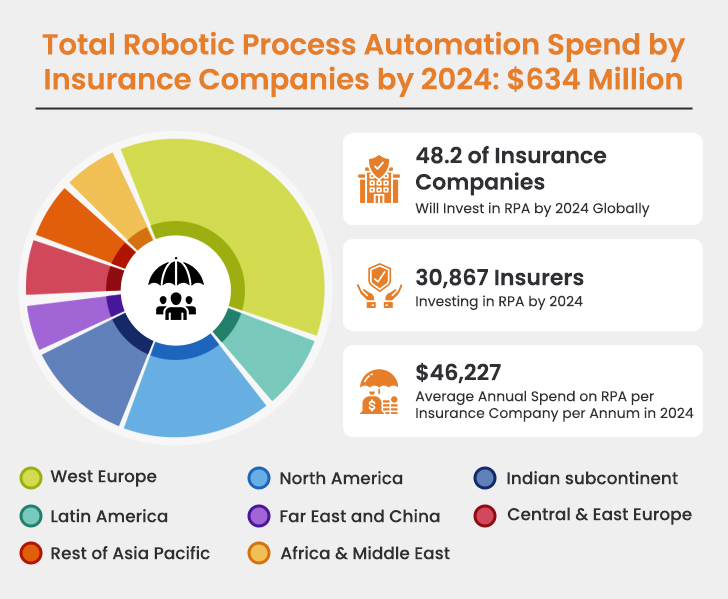

Regardless of size, insurance agencies can transform their businesses and stay competitive with Robotic Process Automation in Insurance operations. This technology is essential as consumers demand a more dynamic, personalized digital experience across insurance products, services, and customer support channels.

According to a report by Forbes, Robotic Process Automation in Insurance has increased claims accuracy to an impressive 99.99%, and operational efficiency saw a 60% increment. Insurance automation has also significantly enhanced customer service activities, resulting in a remarkable 95% improvement in customer experience. Similarly, research from Deloitte reveals that RPA can reduce the time spent on finance and accounting tasks by up to 50%, promoting enhanced operational productivity and cost reduction.

The Value of RPA in Insurance

RPA enhances everyday business processes that consume workers’ time and energy, boosting efficiency and job satisfaction. By utilizing RPA bots, insurers can enhance accuracy and efficiency, freeing human resources for more strategic tasks. Case studies have shown up to a 200% increase in ROI within the first year of RPA deployment in financial services.

Robotic Process Automation in Insurance can also link disparate legacy systems, enabling insurers to conduct operations faster, reduce labor costs, and explore new areas of business innovation. Gartner predicts that by 2025, 70% of new applications written by enterprises will use low-code or no-code technologies.

How Insurance Automation Works

Robotic Process Automation in Insurance bridges the gap between legacy insurance systems, improving customer experience and operational efficiency. RPA platforms can process actions at the mouse and keyboard levels while also integrating with systems at a lower level via application programming interfaces (APIs). Moreover, organizations can use API connectors when building their workflows with RPA for end-to-end automation.

Insurance Automation Solutions are Ideal for a Distributed Workforce and Can Perform Tasks such as:

- Copying and pasting data between different applications

- Opening emails, gathering data, and moving it into a core system

- Calculating data to create month-end profitability reports

- Integrating with workflow automation, rules engines, and other components for fully automated processes

- Using artificial intelligence (AI) add-ons to enhance bot capabilities

Use Cases for Robotic Process Automation in Insurance

Automation and robotics in insurance are already helping insurance companies improve a wide range of data processing tasks:

- Claims management: RPA in insurance accelerates claims processing by 75%. Now, handling small claims can be done within a minute by integrating data across applications, utilizing NLP and OCR for extraction and verification, and minimizing human intervention for faster, customer-focused payouts.

- Underwriting: AI-enhanced RPA bots streamline insurance underwriting by populating data fields, accessing internal/external data, evaluating risks, and analyzing customer history for pricing. They quickly identify risks and fraud, speeding up decision-making and freeing underwriters for complex tasks.

- Call center support: Robotic Process Automation in insurance improves customer service by handling policy renewals and updates automatically, providing instant policy quotes, processing claims swiftly, and offering 24/7 customer support through chatbots. RPA ensures accurate and speedy resolutions to customer inquiries, enhancing overall customer satisfaction.

- Compliance and Regulations: It automates client research, data validation, compliance reporting, data security operations, and account closure notifications while maintaining detailed logs for easy monitoring and internal reviews.

- Registration form handling: The integration of optical character recognition (OCR) with RPA enables insurers to automatically interpret content from registration forms and direct the information into the appropriate workstreams.

- Policy administration: RPA in insurance enhances policy administration efficiency by automating routine tasks such as issuing policies, processing renewals and endorsements, managing regulatory compliance, and handling accounting settlements, enabling a more agile response to growing customer demands.

The Extended Benefits of RPA in Insurance

With the implementation of Robotic Process Automation in Insurance, insurers can improve back-office processes and customer-facing services while transforming the work environment. Some key benefits of using RPA in insurance operations include:

- Faster insurance claims processing: RPA bots can move large amounts of claims data with just one click, speeding up the response time when customers file a claim.

- Higher customer satisfaction: Insurers can expedite a wide range of data-rich processes with RPA, from new business onboarding to policy cancellations.

- Increased data accuracy: By replacing manual processes with RPA, insurers can eliminate potential human errors and increase data reliability.

- Rapid cost savings: RPA is a great way to streamline business operations, increasing productivity for overall cost savings.

- Investment protection: Robots can extend the life of legacy systems and then be updated to work with new systems.

- Cross-selling opportunities: RPA tools like chatbots can deliver customized product recommendations to enhance the customer experience.

- Improved job satisfaction: RPA bots eliminate a wide range of manual data entry tasks so employees can perform more value-added activities.

The Scope of Adopting Robotic Process Automation in Insurance for Agencies

When agencies consider adopting Robotic Process Automation in Insurance, they unlock the potential to significantly enhance operational efficiency across a spectrum of tasks. This shift streamlines workflows and allows human employees to focus on complex, value-added activities. By embracing RPA, insurance agencies join the hyper-automation movement, positioning themselves to innovate, adapt, and maintain a competitive edge in a dynamic industry landscape.

- Integration Capabilities: Agencies should assess their operational ability and need to use robotic process automation in insurance to integrate with existing systems and data sources. Seamless integration ensures a smooth transition and maximizes the benefits of automation.

- Regulatory Compliance: Automation tools must comply with industry regulations. Agencies should look for solutions that facilitate compliance management and can adapt to regulatory changes, ensuring that automated processes align with legal requirements.

- Customization and Scalability: The chosen automation solution should be customizable to the specific needs of the agency and scalable to handle increasing workloads or changes in business size without significant additional investments.

- Cost-Benefit Analysis: Agencies must evaluate the costs of implementation, training, and maintenance against the projected efficiency gains and cost savings. A clear understanding of the return on investment helps justify the adoption of automation.

- Vendor Expertise and Support: Choosing a vendor with proven expertise in the insurance domain and a robust support system is vital. Agencies should look for vendors offering ongoing training, technical support, and updates to keep the automation solutions effective.

Elevate Automation in Insurance Operations with Global Back Office Support

The ongoing advancement of robotics in Insurance promises to unlock unprecedented productivity levels and pave the way for resourceful approaches to industry challenges. As agencies embrace these cutting-edge technologies, they position themselves at the forefront of a rapidly changing landscape, ensuring sustained success and client satisfaction.

Take your Robotic Process Automation in Insurance to the next level with Insurance Back Office Pro – a leader in backoffice support. With our 8 global delivery centers and round-the-clock support, we are always ready to assist you. Experience world-class service designed to streamline your insurance agency processes, enhance productivity, and drive growth. Don’t wait – Contact Us Now and empower your insurance agency with Insurance Back Office Pro today!