In the rapidly evolving insurance industry, companies face numerous challenges ranging from increasing customer expectations to rising costs and market competition. As insurers strive to stay ahead, they are seeking innovative solutions to streamline operations, improve efficiency, and enhance customer experience.

In this data-packed blog, we will explore the promise of claims processing outsourcing and how outsourcing insurance backoffice can address the pain points faced by insurance companies in the current economic landscape.

Current Pain Points in the Insurance Industry:

The insurance industry in 2023 faces a unique set of challenges. With technological advancements and changing customer preferences, insurers must adapt to stay relevant. However, they also face economic uncertainties, market volatility, and rising operational costs. Additionally, insurers are grappling with complex regulatory requirements and the need to provide superior customer service from insurance policy renewal to insurance claims settlement.

50% of the current 800,000 insurance workforce will retire over the next 15 years, says U.S. Bureau of Labour Statistics. Unless insurers opt to outsource their back-end functions, they could encounter a significant staffing challenge on a global scale. Outsourcing these functions offers the opportunity to enhance operational flexibility and scalability.

Navigating Through the Hurdles: Outsourcing as a Solution

Leading insurance companies have recognized the potential of outsourcing claim processing as a strategic solution. Fortunly predicts that the BPO market is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of 8% and estimating that the market will reach a staggering $405.6 billion by 2027. By leveraging the expertise of third-party service providers, insurers can overcome their pain points while focusing on their core competencies.

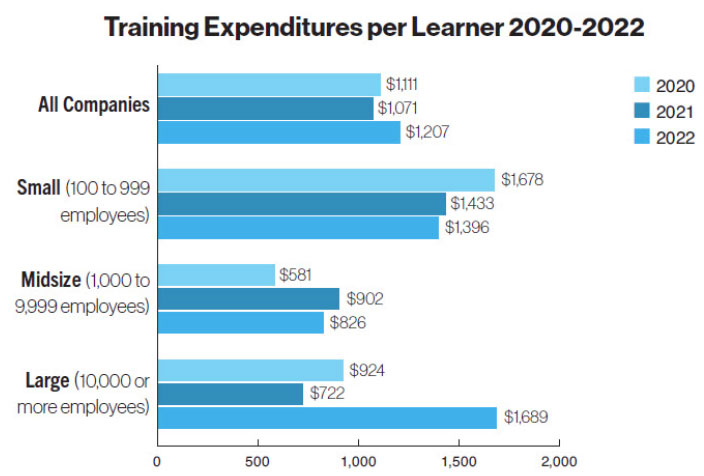

- Cost Savings and Efficiency: Outsourcing claim processing provides cost-effective solutions, reducing operational costs such as staffing, training, and infrastructure investment. On average, small American companies spend $1,689 to train each employee, making outsourcing a viable option for significant cost savings.

- Improved Customer Experience: Outsourcing claim handling to experienced service providers ensures prompt and accurate processing, enhancing customer satisfaction. Advanced technologies and automated processes employed by third-party providers lead to faster claim settlements and reduced errors, resulting in an improved overall customer experience.

- High Success Rate: Outsourced claim processing models optimize the claims handling process by employing industry best practices. With expertise and experience, these providers achieve higher success rates, minimizing claim disputes and delays. This not only benefits insurers but also enhances their reputation and builds trust with customers.

- Increased Productivity: By outsourcing claim processing, insurance companies can focus on core functions like underwriting, risk assessment, and business development. This allows for the efficient allocation of internal resources, leading to improved productivity and the successful achievement of strategic objectives.

Factors to Consider While Choosing a Credible Outsourcing Partner:

While outsourcing claim processing offers numerous benefits, insurers should carefully evaluate several factors when choosing a third-party service provider:

- SLA: Insurers should establish clear SLAs with outsourcing partners to ensure consistent performance, turnaround time, and quality benchmarks. A well-defined SLA promotes transparency, accountability, and collaboration.

- Technologies: Evaluate potential outsourcing partners’ technological capabilities, including automation, AI, and machine learning. These advanced technologies enhance claims processing efficiency, accuracy, and speed.

- Risk Management: Consider the outsourcing partner’s risk management practices and data security measures. Ensure compliance with industry regulations, robust security protocols, and contingency plans for effective risk mitigation.

- Industry Expertise: Choose a service provider with a proven track record in the insurance industry. Assess their domain knowledge, experience, and understanding of insurance processes and regulations.

- Scalability and Flexibility: Select an outsourcing partner capable of scaling resources and adapting to changing claim volumes, ensuring consistent service delivery even during peak times.

- Data Analytics and Reporting: Evaluate the provider’s ability to analyze claims data and generate meaningful reports. Advanced analytics enable trend identification, fraud detection, and continuous process optimization.

Conclusion on Claims Processing Outsourcing:

- Post-pandemic, about 45% of global corporations plan to expand outsourcing efforts,

- Cloud technology enables around 90% of companies to access a broader pool of distributed professionals, opening new outsourcing opportunities.

- IT outsourcing spending is projected to exceed $1.3 trillion by 2023

- Cost reduction remains a primary driver for approximately 70% of companies when outsourcing, mitigating expenses associated with in-house staff.

- Around 24% of small businesses outsource to enhance operational efficiency and access specialized skills not available internally.

Outsourced claim processing models present a promising solution for insurers navigating the challenges of the insurance industry in 2023. Contact at insurancebackofficepro.com to partner with us for specialized service, achieve cost savings, enhance customer experience, improve success rates, and increase productivity.

We possess the necessary service level agreements, employ cutting-edge technologies, implement robust risk management practices, and possess extensive industry expertise to effectively handle your medical billing process, making us an ideal outsourcing partner.

No Comments